Self-insuring through predictable recovery for production and end-of-use scrap.

Self-Insuring Through Predictable Recovery

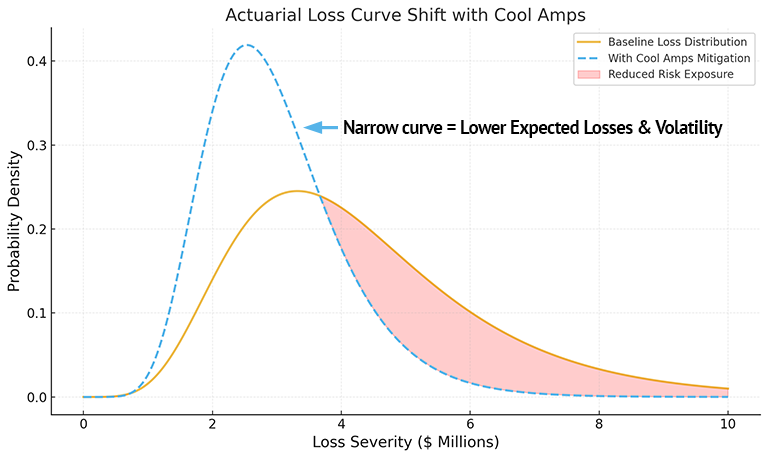

Instead of paying insurers to cover material shortages or catastrophic scrap losses, manufacturers can self-insure by creating circular material buffers through Cool Amps. This transfers risk from an insurer to an engineered process. Premiums become productive assets that recover value.

-

Insurance Cost

OffsetReallocate money that would have gone to premiums toward operating Cool Amps units that provide tangible value.

-

Regulatory Liability

MitigationNeutralize and recycle scrap in alignment with EPA and OSHA to lower fines, litigation, and environmental cleanup exposure.

-

Reduced Downtime

IncidentsBy keeping a reliable secondary supply, Cool Amps helps ensure smoother production schedules and less unplanned downtime.

Traditional Insurance vs. Cool Amps

The difference between expensed coverage and productive risk reduction.

-

How coverage works today

Insurers price premiums on the probability and severity of loss events

-

Fire risk

Hazardous scrap storage drives high-severity events.

-

Environmental cleanup

Contamination and remediation add cost and delay.

-

Shortages

Material interruptions trigger emergency buying.

-

Liability

Downstream product exposure inflates premiums.

Outcome: Premiums are sunk costs with no residual value.

-

-

How we are changing the model

We replace priced risk with engineered recovery at the source

-

Circular value

Scrap becomes high-purity feedstock that stays in inventory.

-

Risk mitigation

Lower exposure to fires, spills, storage fines, and hazards.

-

Continuity

Fewer shortages, smoother schedules, less emergencies.

-

Productive assets

Recovered materials replace expensed premiums.

Outcome: Dollars once lost to premiums return as feedstock.

-

Simple, Realistic Comparison

Illustrative math for a large plant.

-

Baseline Insurance Premium

$4.0M / year

Across general liability, environmental impairment, and business interruption.

-

Total With Cool Amps Deployment

$3.4M / year

Annualized Cool Amps system + ops − $2.0M

Net recovered materials value − $1.2M

New insurance premium (35% reduction) − $2.6M -

Net Benefit

$0.6M / year

In this scenario, Cool Amps pays for itself, operations are safer, asset value is retained, and hundreds of thousands drop to the bottom line.

If credits reach 45% or recovery nets higher, the savings and ROI widen. If credits are lower, recovered-value and tail-risk reduction still improve total cost of risk vs. premium only.